What is Investment Banking? (Overview of what do they Fundamentals Explained

Not known Factual Statements About Investment Banking - Needham

Analysts and senior bankers invested the previous numerous hours going over material and producing "remarks," which often require huge modifications to the pitchbook. Financial investment banking partners and experts work with many other professionals such as equity research and sales staff. The Software application Crew The nights, nevertheless, are carefully spent with the desktop publishing teams.

What Investment Banking Industry Challenges Are Obstructing Growth - Infiniti's Market Experts Discuss Strategies to Overcome Hurdles - Business Wire

Experts rely greatly on this team to make modifications to pitchbooks and other marketing materials. The revision-comment-correction cycle might duplicate two or 3 more times prior to the night ends. Associates and analysts have to believe and work quickly to guarantee edits are done correctly and on time. Many banks have business car services set up to take partners and experts home in the early hours of the morning.

m., but junior bankers generally plunge house in the early hours of the morning to get a couple of hours of sleep before doing it all again the next day.

How Many Hours do Investment Bankers Really Work?

The Facts About Investment Banking - Needham Revealed

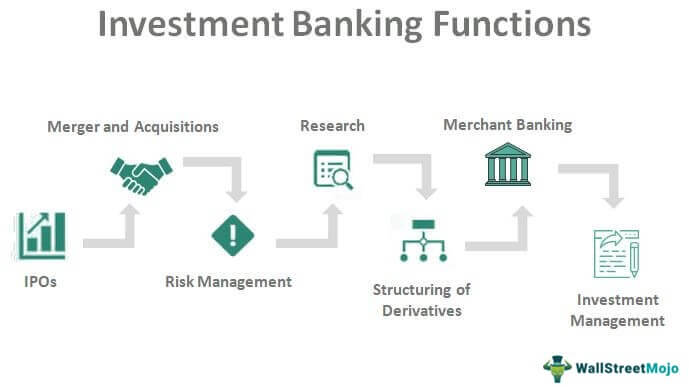

What Is Financial investment Banking? Financial investment banking is a particular division of banking related to the production of capital for other companies, governments, and other entities. Key Takeaways Investment banking deals primarily with the development of capital for other companies, federal governments, and other entities. Another Point of View banking activities consist of underwriting new financial obligation and equity securities for all types of corporations, assisting in the sale of securities, and assisting to facilitate mergers and acquisitions, reorganizations, and broker trades for both institutions and private investors.

Comprehending Financial Investment Banking Investment banks finance new financial obligation and equity securities for all kinds of corporations, aid in the sale of securities, and help to assist in mergers and acquisitions, reorganizations, and broker trades for both organizations and personal investors. Investment banks also offer guidance to issuers relating to the problem and placement of stock.

Broadly speaking, financial investment banks assist in big, complex monetary deals. They may provide guidance on just how much a business deserves and how finest to structure an offer if the investment banker's client is thinking about an acquisition, merger, or sale. It may likewise consist of the providing of securities as a way of raising money for the client groups and developing the paperwork for the Securities and Exchange Commission necessary for a business to go public.